Have you ever wondered how to grow your money faster? How to become rich like your peers?

Buying stocks? or even Crypto?

Start a business?

Well, yeah maybe. I said maybe because even if you followed their paths, it does not mean you will get what they got as well.

Then, what’s the point of this post? Imma leaves.

WAIT! I promised you that I will tell you the sure way to become wealthy (not rich).

Okay, good? Let’s start.

1. Check your Financial Health

If you want to grow your money faster, you’ll need to know your current financial health.

- Do you have an income? (You need to have an income to grow money, or else what to grow?)

- Do you have any debts? (Preferably don’t have any debts, but we don’t know everyone’s situation right?)

- Is it higher than your income? (Well, if it’s higher, then it means you cannot pay your own debt.)

- Do you save every month? (It’s okay if it’s not that much, 10$ is better than none)

These are a few questions you need to ask yourself and answer honestly. Do all the calculations, even if it’s scary.

If you pass all the questions, congrats!

At least, you can take care of your own ass.

2. Track and allocate.

Second of all, do you track your expenses? Well if you don’t, I suggest you do so.

By tracking your expenses, you will know how much you spent each month on average.

But, I’m forgetful, how can I track every single expense.

Well, maybe you can go the second route. Allocate your monthly budgeting.

There are two routes to choose from:

- Lazy way:

If you hate doing tedious things like spreadsheets and you have two debit cards, you can allocate a monthly allowance on one card, and use the other one for savings.

It’s easier this way, and it allows you to spend whatever you want as long as you still got the money on the card. Keep in mind to never transfer more money from the savings card.

- Nice way:

If you are a spreadsheet guru, then I highly recommend you to use spreadsheets on creating monthly budgeting. It’s easier to track and more flexible.

Either way, if you track and allocate, then you are good to go!

3. Invest

You need to complete previous the two steps before going to the third step.

Now we are talking about the real deal here.

Why do we need to invest?

Is it even safe?

Will we go bankrupt?

We need to invest because savings is not helping us on growing money. Period.

Have you ever noticed how things are getting more expensive each year? That’s called inflation.

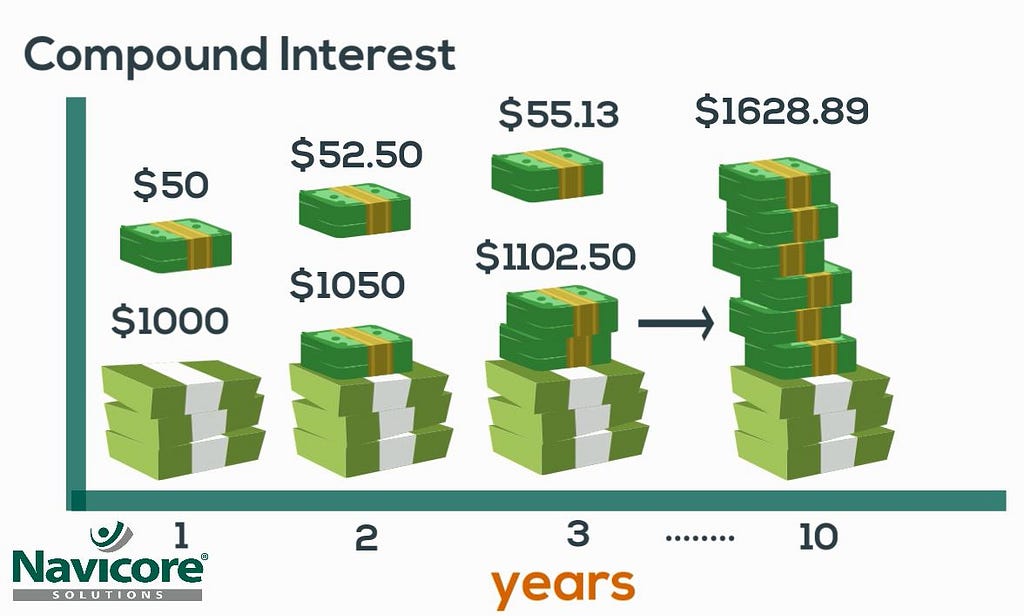

In order to beat inflation, we need to invest and take advantage of compounding interest.

Now, what is compounding interest? Reinvesting the result of our investment to create more profits.

Wait, before we dive too deep into investing, there are three things you need to do first:

- Build your emergency funds

What I mean by emergency funds is money that are used in case of unexpected expenses (E.g. hospital costs, you get fired, vehicle reparation, etc).

If you haven’t done the second step, which is Track and Allocate, you won’t know how much emergency funds you need to have.

The rule of thumb is six to twelve times your monthly expenses.

If you have a family, I suggest going twelve times.

So that means even if you get fired, at least you’ll be able to live for 12 months.

- Get an insurance

People will be thankful for insurance that they got only after they got into a problem. Some insurances will cover up to 100% of the costs.

Please consider getting it if you don’t have one. Better be safe than be sorry.

- Use only cold cash

Cold cash? What is that?

Cold cash is money that is ready to use.

Money that is idling in the bank.

You wouldn’t want to risk your meal allowance for something uncertain.

After you’ve done these points, at least you have a safety net to catch you even if you lost all your money.

You need to remember that investing by no means is a sure get rich quick tool. It’s uncertain like how we cannot predict the future.

There are few investing instruments in the world ranging from low profit but stable investments, or high-risk high-return investments.

I suggest that if you are a beginner, learn as much as you can about an instrument that you are interested to buy.

In that way, at least you understand what you buy. Be a smart buyer, don’t be a gambler.

These are a few instruments that I knew:

- Mutual Funds

- Obligation

- Stocks

- Forex (Foreign Exchange)

- Cryptocurrencies

Final Notes

These are steps that will help you get wealthier in the long run.

Go for a long marathon, not a short sprint.

For a quick summary, these are the steps you need to take:

- Check Your Financial Health

- Track and Allocate

- Invest

Learn along the way with your practice.

Don’t be a FOMO (Fear of Missing Out) in the investment world, It will do you no good.

Good luck dude!